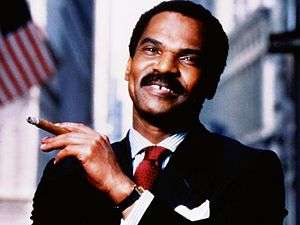

Reginald Lewis

| Reginald Lewis | |

|---|---|

| |

| Born |

Reginald F. Lewis December 7, 1942 Baltimore, Maryland, U.S |

| Died |

January 19, 1993 (aged 50) New York City, New York, U.S |

| Relatives | Loida Nicolas-Lewis (wife) |

Reginald F. Lewis (December 7, 1942 – January 19, 1993), was an American businessman. He was the richest African-American man in the 1980s. Born in Baltimore, Maryland, he grew up in a middle-class neighborhood. He won a football scholarship to Virginia State College, graduating with a degree in political science in 1965. He graduated from Harvard Law School in 1968 and was a member of Kappa Alpha Psi.

In 1992, Forbes listed Lewis among the 400 richest Americans, with a net worth estimated at $400 million. He also was the first African-American business owner to build a billion dollar company, Beatrice FoodEducations.

Education

During his high school years at Dunbar, Reginald excelled in both his studies and sports. As quarterback of the football team, shortstop on the baseball team, and a forward on the basketball team, he served as captain for all three teams. Reginald was also elected vice president of the student body; his friend and classmate, Robert M. Bell (current Chief Judge of Maryland), was elected president. In addition, Reginald worked nights and weekends at jobs with his grandfather, a head waiter and maitre d'.

In 1961, Reginald entered Virginia State University on a football scholarship, majoring in economics. He graduated on the Dean's List despite having a rough first year academically as well as losing his scholarship due to an injury. After losing his scholarship, he worked in a bowling alley and as a photographer's assistant to help pay his expenses. In his senior year, the Rockefeller Foundation funded a program at Harvard Law School to select a few black students to attend summer school at Harvard to introduce them to legal studies in general.

At the end of the program, Reginald was invited to attend Harvard Law School - the only person in the 148-year history of Harvard Law to be admitted before applying to the school. He arrived at Harvard with $50 in his pocket. During his third year at Harvard, he discovered the direction for his future career in a course on securities law. He wrote his third-year paper on takeovers. He graduated from Harvard Law School in 1968 and went to work for a prestigious New York law firm (Paul, Weiss).

Business career

Recruited to top New York law firm Paul, Weiss, Rifkind, Wharton & Garrison LLP immediately after law school, Lewis left to start his own firm two years later. After 15 years as a corporate lawyer with his own practice, Lewis moved to the other side of the table by creating TLC Group L.P., a venture capital firm, in 1983.

His first major deal was the purchase of the McCall Pattern Company, a home sewing pattern business for $22.5 million. Lewis had learned from a Fortune magazine article that the Esmark holding company, which had recently purchased Norton Simon, planned to divest from the McCall Pattern Company, a maker of home sewing patterns founded in 1870. With fewer and fewer people sewing at home, McCall was seemingly on the decline—though it had posted profits of $6 million in 1983 on sales of $51.9 million. At the time, McCall was number two in its industry, holding 29.7 percent of the market, compared to industry leader Simplicity Patterns with 39.4 percent.

He managed to negotiate the price down and then raised $1 million himself from family and friends and borrowed the rest from institutional investors and investment banking firm First Boston Corp.

Within one year, he turned the company around by freeing up capital tied in fixed assets such as building and machinery, finding a new use for machinery during downtime by manufacturing greeting cards, and he then started to recruit managers from rival companies. He further strengthened McCall by containing costs, improving quality, beginning to export to China, and emphasizing new product introductions. This new combination led to the company's most profitable year in its history. With the addition of McCall real estate worth an estimated $6 million that the company retained ownership of, he later sold McCall at a 90-1 return, resulting in a tremendous profit for investors. Lewis's share was 81.7 percent of the $90 million.

In 1987, Lewis bought Beatrice International Foods from Beatrice Companies for $985 million, renaming it TLC Beatrice International, a snack food, beverage, and grocery store conglomerate that was the largest African-American owned and managed business in the U.S. The deal was partly financed through Mike Milken of the maverick investment bank Drexel Burnham Lambert. In order to reduce the amount needed to finance the LBO, Lewis came up with a plan to sell off some of the division's assets simultaneous with the takeover.

When TLC Beatrice reported revenue of $1.8 billion in 1987, it became the first black-owned company to have more than $1 billion in annual sales. At its peak in 1996, TLC Beatrice International Holdings Inc. had sales of $2.2 billion and was number 512 on Fortune magazine's list of 1,000 largest companies.

Philanthropy

In 1987 Lewis established The Reginald F. Lewis Foundation, which funded grants of approximately $10 million to various non-profit programs and organizations while he was alive. His first major grant was an unsolicited $1 million to Howard University in 1988; the federal government matched the grant, making the gift to Howard University $2 million, which was used to fund an endowment for scholarships, fellowships, and faculty sabbaticals.[1] In 1992, he donated $3 million to Harvard Law School, the largest grant at the time in the law school's history.[2] In gratitude, the school renamed its International Law Center the Reginald F. Lewis International Law Center, the first major facility at Harvard named in honor of an African-American.[3]

While alive, Lewis made known his desire to support a museum of African American culture. In 2005, the Reginald F. Lewis Museum of Maryland African American History & Culture opened in Baltimore with support from a $5 million grant from his foundation.[4] It is the East Coast’s largest African American museum occupying an 82,000 square-foot facility with permanent and special exhibition space, interactive learning environments, auditorium, resource center, oral history recording studio, museum shop, café, classrooms, meeting rooms, outside terrace and reception areas.[5] It highlights the history and accomplishments of African Americans with a special focus on Maryland’s African American community. The museum is also a Smithsonian affiliate.

Personal life

Reginald Lewis was married to Loida Nicolas-Lewis. They had two daughters, Leslie and Christina. He died at age 50, from brain cancer. Nicolas-Lewis took over the company a year after his death.[6]

References

- ↑ "RFL Beach Glamour". www.reginaldflewis.com. Retrieved 4 August 2016.

- ↑ "The Reginald F. Lewis Fellowships for Law Teaching". Harvard Law School. Retrieved 4 August 2016.

- ↑ "About Reginald Lewis". Harvard Law School. Retrieved 4 August 2016.

- ↑ "Reginald F. Lewis" Archived March 5, 2014, at the Wayback Machine.

- ↑ "The Reginald F. Lewis Museum". www.rflewismuseum.org. Retrieved 4 August 2016.

- ↑ Jonathan P. Hicks (January 20, 1993). "Reginald F. Lewis, 50, Is Dead; Financier Led Beatrice Takeover". The New York Times.

External links

- Reginald F. Lewis Official Website

- Reginald F. Lewis Museum of African American Culture & History

- Reginald F. Lewis Fellowship - Harvard

- The Lewis College

- Reginald F. Lewis High School - Baltimore

- Reginald F. Lewis Fan Club

Articles

- "Michael Milken - Philanthropist, Financier, Medical Research Innovator, Public Health Advocate". www.mikemilken.com. Retrieved 20 July 2016.

- "Michael Milken - Philanthropist, Financier, Medical Research Innovator, Public Health Advocate". www.mikemilken.com. Retrieved 20 July 2016.

- Alan Harper, Peter. "TLC Beatrice to Liquidate". www.afrocentricnews.com. Retrieved 20 July 2016.

- "TLC Beatrice International Holdings, Inc. History". www.fundinguniverse.com. Retrieved 20 July 2016.

- Jr, JUBE SHIVER (13 September 1989). "McCall Pattern's Owners Sue Seller, Charging Fraud". Los Angeles Times. Retrieved 20 July 2016.

Books

- Lewis, Reginald F.; Walker, Blair S. (1995). "Why should white guys have all the fun?" : how Reginald Lewis created a billion-dollar business empire. New York [u.a.]: Wiley. ISBN 9780471042273. Retrieved 20 July 2016.

- Steele, Donald L. Barlett, James B. (1992). America : What Went Wrong? (16. print ed.). Kansas City: Andrews and McMeel. ISBN 9780836270013. Retrieved 20 July 2016.

- Hart, Lin. Reginald F. Lewis Before TLC Beatrice: The Young Man Before The Billion-Dollar Empire. LHA Publishing Company. ISBN 9780985347925. Retrieved 20 July 2016.